STREAMWIDE 2021 REVENUE: €16.7m (up 20%)

STREAMWIDE, the expert in critical communications software solutions, posted revenue of €16.7 million in 2021, up sharply by 20% (€2.8m).

As announced when first half revenues were published on the 19 July 2021 and confirmed on the 20 September 2021, 2021 revenues rose significantly despite the pandemic context, following several consecutive years of strong growth in the team on mission and team on the run critical communications platforms, with revenues reaching €11m in 2021.

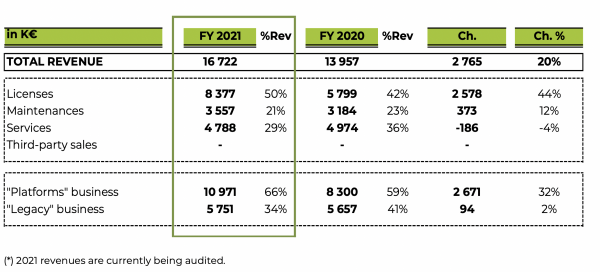

2021 revenue breaks down as follows:

CONTINUED GROWTH MOMENTUM IN 2021

Development and strong growth in new solutions: the new critical communications platforms team on mission and team on the run, whose full- year revenues increased by €2.7m, now account for almost 66% of the Group’s total revenue (up 7 percentage points compared to 2020).

This growth is the result of continued benefits of the partnership with the Secure Land Communications (SLC) division at Airbus Defence and Space, the ongoing roll-out of the PCSTORM project, as well as new contracts and projects with French municipalities and private companies won and launched in 2021, including with a new government department.

2021 platform revenue of €11 million includes revenue from licences (€6.5 million) and services (€4 million), up €2.4 million and €0.1 million respectively.

Maintenance revenue is still non-material (€0.5m), however continued to increase significantly (up 64%) in 2021. This trend is expected to continue over the coming half-year periods.

Strong resilience of the “legacy” business: the core “legacy” business (telecom operator solutions), which requires little to no capital investment, was almost stable in 2021 (up €0.1m) and still represents 34% of annual revenue (€5.7m). License sales, which are non-recurring in nature, increased €0.2 million over the period to €1.9 million in 2021, following major new contract wins in North America in the second half of the year and an extended user base. “Legacy” services (€0.8 million) fell by €0.3 million following two 2020 projects that entered the production phase in 2021. Alongside these 2021 extensions and production launches, maintenance revenues increased €0.2 million to €3.1 million in 2021.

OUTLOOK: EARNINGS GROWTH, STRUCTURAL PROJECTS AND A NEW ORGANISATION

As announced, the €1.5 million increase in revenues in the second half of the year (up 20% to €8.8 million) resulting in significant growth in full-year revenues (up €2.8 million or 20%), should ensure that 2021 EBIT significantly increases compared to 2020.

Structural projects in Europe have been in the final validation phase for a number of months now, and the Group remains well positioned for selection as one of the successful bidders. However, the current political context and election campaigns, particularly in France and Italy, calls for a certain amount of caution as to the completion of some of these projects in the short term.

In parallel to these governmental projects, the Group continues its commercial strategy to diversify revenue sources by developing a network of partners and distributors, which will enable the Group to seize a range of opportunities relating to the software platforms offered.

In order to target and structure growth in a sustainable manner, the Group has been strengthening, expanding and reorganising its teams for a number of months. STREAMWIDE and its various subsidiaries made a number of new hires throughout 2021 (27 new positions created at 2021 year-end compared to 2020 year-end). The Group is also completely refurbishing and renovating its Paris premises. Finally, development teams are now structured to follow the agile methodology. This new organisation seeks to maintain the Group’s strong capacity to develop and invest in its solutions, while also ensuring high quality and an “end to end” approach for products, their features and components (servers, mobile and web applications).

The Group therefore aims to maintain strong growth momentum and to secure the staff and technological resources required to achieve this.

Meanwhile, cash flow remained largely positive and made it possible to continue investing in the new team on mission and team on the run critical business and communications solutions. All of these developments (new operational features, complete suite of collaborative tools, TAS, SDK, API, provisioning, etc.) are integrated into secure, scalable and sovereign technical architectures, which is a genuine point of difference compared to other existing solutions.

The Group is confident in the suitability of its solutions for the markets it serves and in the technological edge they offer. The Group is still positioned as a major player in the critical communications market, and the only uncertainty is how quickly these new generation solutions can be made available to the entire addressable market. Investments made in human resources and technologies in 2021 will continue in 2022, putting the Group in a position to take advantage of future growth in the critical communications market.

Read more